By Vamsi Chemitiganti

The Financial Services industry is undergoing a major transformation. Innovation in data technologies is driving growth of predictive analytics and data mining techniques that will dramatically change banking over the next few years. This is the second in a series of posts that will describe that transformation. The first can be found here. This second post examines concrete use cases enabled by a data-driven approach in the industry.

“Data! Data! Data!” he cried impatiently. “I can’t make bricks without clay!”

– Sherlock Holmes, Conan Doyle’s “The Adventure of the Copper Beaches”

Big Data platforms powered by

Open Enterprise Apace Hadoop not only economically store large volumes of structured, unstructured, or semi-structured data, but also process this Big Data at scale. The result is a steady supply of continuous and actionable intelligence. With the advent of Hadoop and Big Data ecosystem technologies, Financial Services are now able to ingest, onboard, and analyze massive quantities of data at a much lower price point.

Users can not only generate insights using a traditional ad-hoc querying or descriptive intelligence model, but also build advanced statistical models on the data. These advanced techniques leverage data mining tasks such as classification, clustering, regression analysis, and neural networks to perform highly robust predictive modeling. Owing to Hadoop’s ability to work with any kind of data, this encompasses both traditional data and real-time, streaming data.

Data In Banking

IT specialists in the Financial Services industry have been tackling the challenges of siloed data for years. Consider some of the traditional and internal sources of data used in banking:

- Customer account data and demographics

- Core banking data

- Transactional data at every level of detail

- Wire and payment data

- Trade and position data

- General ledger data including accounts payable, accounts receivable, cash management, purchasing information

- Support data from banking reporting

All of this data used to be human generated, but advances in smart sensors, telemetry-based devices, and POS terminals, among others, are generating data at an unprecedented scale. The sheer nature of mobile apps ensures that the growing network of interconnected apps, including unstructured social media apps, will continue to generate massive amounts of data and data challenges.

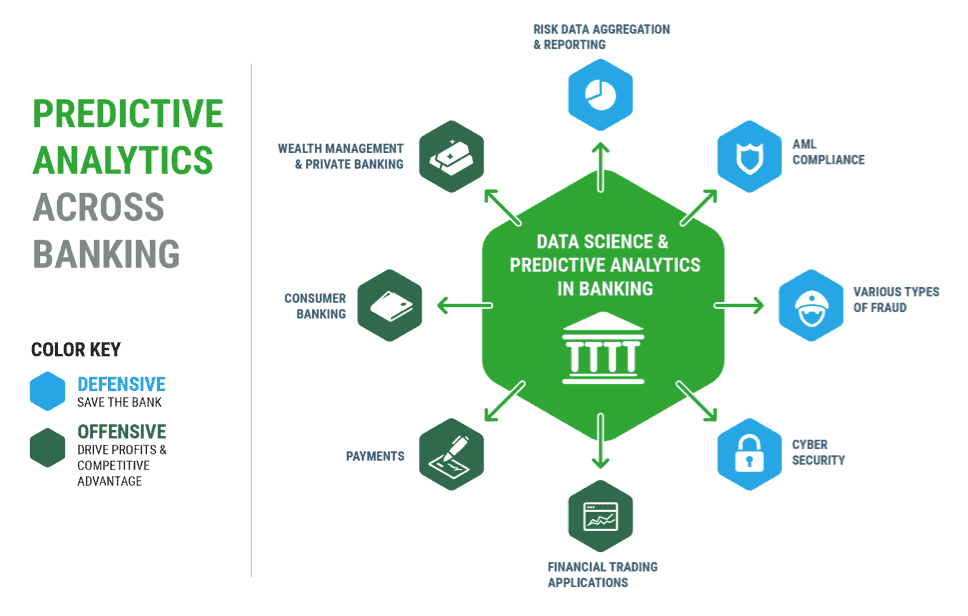

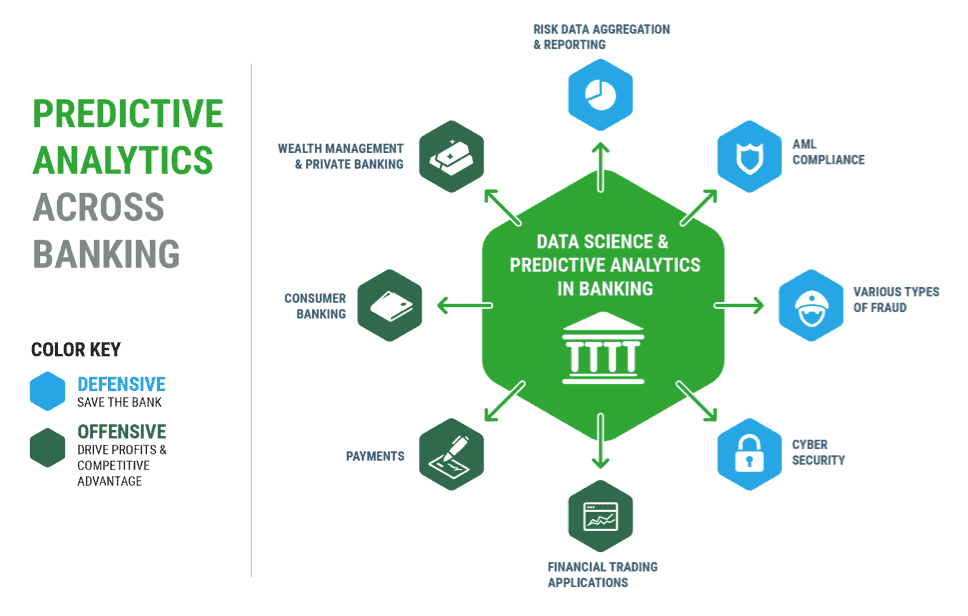

Predictive Analytics & Defensive Use Cases Across the Banking Spectrum

Risk, Fraud, & Security (RFC)

Predictive Analytics & Defensive Use Cases Across the Banking Spectrum

Risk, Fraud, & Security (RFC)

Internal Risk & Compliance departments are increasingly turning to data science techniques to create and run models on aggregated risk data. Multiple types of models and algorithms are used to find patterns of fraud and anomalies in the data to predict customer behavior. Examples include:

- Bayesian filters

- Clustering

- Regression analysis

- Neural Networks

Data scientists and business analysts are armed with components such as

MapReduce,

Spark (via Java, Python, R),

Storm,

SAS, and others to create these models. This makes the development of fraud models very straightforward to implement on Hadoop.

One of the applications for Data Science is risk data aggregation and measurement.

This includes predicting different risk metrics across the market. In consumer banking, sectors such as mortgage banking, credit cards, and other financial products, all heavily leverage data science to classify products and customers into different risk categories.

Predictive models have also been developed to constantly analyze customer spending patterns, location and travel details, employment details, and even social networks for real-time detection of account compromises.

Capital Markets

Data Science augments trading infrastructures in several ways. It helps re-tool existing trading infrastructures so that they are more integrated and efficient by helping plug in algorithm based complex trading strategies across a range of asset classes, including equities, FOREX, ETFs, and commodities. It also helps with trade execution after Hadoop incorporates newer and faster sources of data, beyond the conventional sources.

Trade Strategy is another use case as heterogeneous data, ranging from market data, existing positions, corporate actions, and unstructured social media data, are all blended together to obtain insights into possible market movements, trader yield, and profitability across multiple trading desks.

Consumer Banking & Wealth Management

Data Science has been proven in several applications in consumer banking. Techniques such as pattern, marketing, and recommendation analysis are becoming fairly common. One can see a clear trend in early adopter consumer banking and private banking institutions movement towards an “analytics first” approach to creating new business applications.

Currently most retail and consumer Banks lack a comprehensive view of their customers. However, by leveraging the ingestion and predictive capabilities of a Hadoop based platform, Banks can provide a user experience that rivals the most popular social media platforms, while obtaining a full picture of their customers across all touch points

The Road Ahead

How can leaders throughout the Banking industry leverage predictive analytics? I posit there are four ways:

- Use their data to create digital platforms that better engage customers, partners, and employees

- Capture and analyze all available streams to develop a 360 degree view of the retail customer

- Create data products by breaking down data silos and other internal organizational barriers

- Use data-driven insights to support a culture of continuous innovation and experimentation

Predictive Analytics & Defensive Use Cases Across the Banking Spectrum

Risk, Fraud, & Security (RFC)

Internal Risk & Compliance departments are increasingly turning to data science techniques to create and run models on aggregated risk data. Multiple types of models and algorithms are used to find patterns of fraud and anomalies in the data to predict customer behavior. Examples include:

Predictive Analytics & Defensive Use Cases Across the Banking Spectrum

Risk, Fraud, & Security (RFC)

Internal Risk & Compliance departments are increasingly turning to data science techniques to create and run models on aggregated risk data. Multiple types of models and algorithms are used to find patterns of fraud and anomalies in the data to predict customer behavior. Examples include:

Ponmmdfgre

hiya

acd

acdy56uij6j56ugj

lorem ipsum

good article!!!

next comment after hina ))